This article first appeared in Carbon Pulse

By Ross McKenzie, EVP & Co-Leader at Elimini

Progress rarely follows a straight line, yet the voluntary carbon market appears to be the exception heading into 2026. External pressures this past year ranged from the explosion in energy demand as the AI race reached full steam, to shifts in the policy and economic landscapes, creating new headwinds for broadscale decarbonization efforts. Despite this the VCM’s trajectory remained resolute, setting the stage for a robust and growing year ahead.

The voluntary carbon market (VCM) entered 2025 with momentum and closed out the year having reshaped expectations for what’s possible in engineered carbon removal. The past twelve months saw a surge in large-scale deals, broader participation from corporate buyers, and the emergence of new removal pathways, from biochar to biomass sequestration. Interest in Bioenergy with Carbon Capture and Storage (BECCS) continued to solidify, and for the first time, the market demonstrated the diversity of durable carbon removal solutions needed to credibly deliver net-zero commitments at scale.

This rising confidence was reinforced at COP30, where carbon trading took center stage. Negotiators made meaningful progress toward establishing the global structures required for transparent, interoperable carbon markets. Integrity and permanence of carbon removals were a central theme. The global conversation has clearly shifted from whether carbon markets should play a role in climate action to how they must evolve to ensure high-quality, durable climate impact.

Against this backdrop, 2026 is poised to be a year of pragmatism with the VCM taking on greater significance in decarbonization pathways. Companies facing intensifying customer expectations, supply-chain pressures, and near-term climate targets are expanding their decarbonization toolkits. Carbon credits, especially engineered removals, are no longer viewed as supplemental. They are becoming strategic assets that offer optionality, resilience, and credibility in an increasingly complex operating environment.

The End of Puritanism in Climate Solutions

For much of the last decade, many companies bet heavily on a narrow set of decarbonization levers: electrification, renewable procurement, and incremental efficiency gains. These remain essential investments, but economic and political shifts have exposed their limitations.

Permitting delays, supply-chain constraints, fluctuating power markets, and rising capital costs are complicating corporate decarbonization timelines. In parallel, key sectors—particularly those with hard-to-abate processes—are discovering that technology pathways alone struggle to keep pace with near-term climate commitments.

The result: the era of “solutions puritanism” is fading. Companies are embracing hybrid-realistic strategies, where carbon credits complement on-site and supply-chain actions rather than replace them. This shift is not ideological, it is pragmatic. It reflects the recognition that avoidance-only pathways cannot reliably deliver emissions reductions at the speed and scale required. It equally doesn’t deter from the ambition to ultimately decarbonize where possible.

The Rise of the Portfolio Approach to Unlock Flexibility and Value

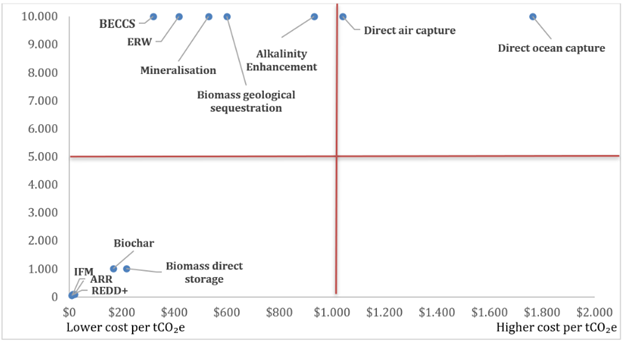

The same political and economic shifts driving organizations away from puritan solutions also incentivize them to diversify their holdings to incorporate flexibility and mitigate risk. Viewed as a portfolio of solutions, biomass, biochar, Biomass with Carbon Removal and Storage, BECCS and other biogenic technologies can work as an effective hedge for sophisticated purchasers and provide a simple entry point for new buyers.

As the VCM matures, the diversity of credit types spanning engineered removals, nature-based solutions, biomass pathways, and more gives buyers unprecedented flexibility. In 2026, the most sophisticated corporate climate strategies will treat carbon credits as a portfolio, not a singular asset.